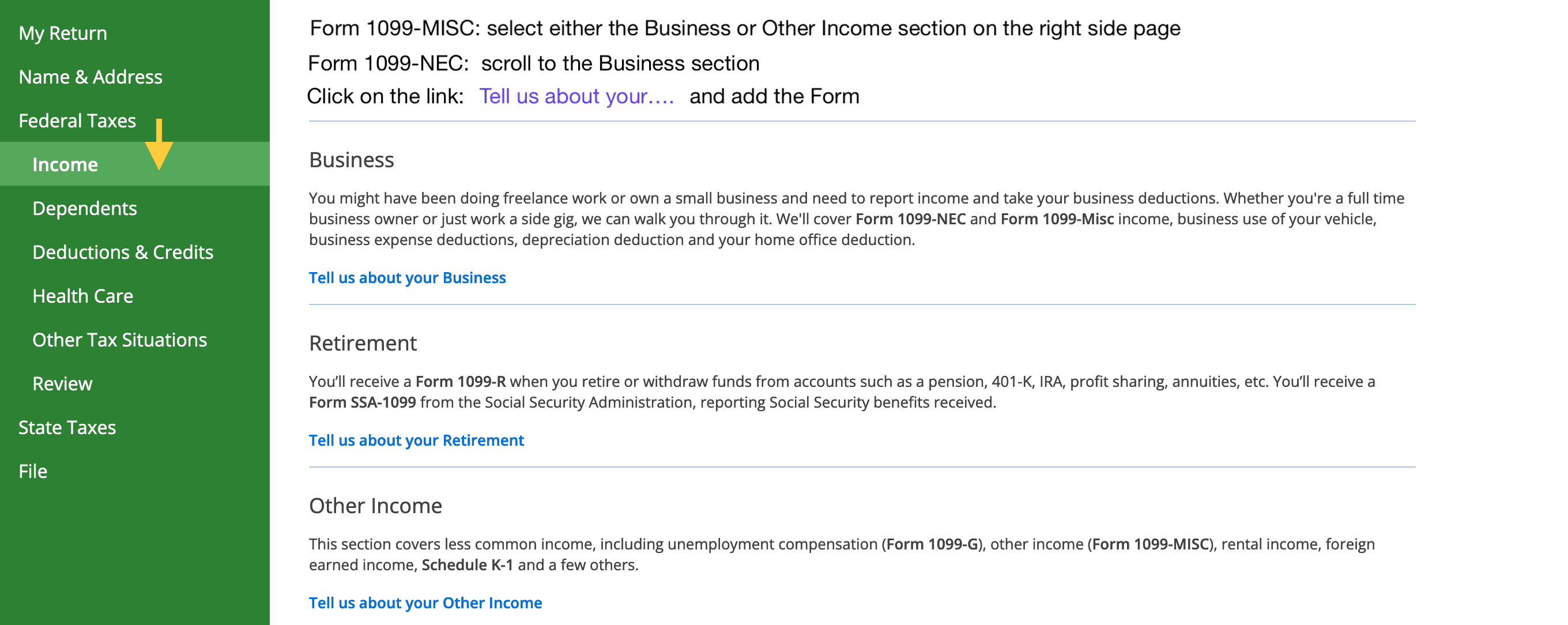

To file your return including income from your 1099 Form, we recommend you simply start the tax interview so you can be walked through all of the income section. As you work, you will be brought to the

Income section where you can add your 1099-MISC and/or 1099-NEC under the

Business section. Form 1099-MISC can either be added to the

Business section or the Other Income section. For example, hobby income could be added to the Other Income section. If you received a 1099-MISC for your business income, add it under

Business so self-employment taxes can be calculated for you.