How to Fill Out or Complete a W-4

Pick one of these 2 options to create your Form W4. The online W-4 Form Creator guides you through to just fill out a Form W-4 without additional calculations. Just follow the step by step instructions and a W-4 PDF will be created. For more tax planning purposes, use the PAYucator and enter your current or future paycheck information and your W-4 PDF will be created based on that for you. Make adjustments based on your tax goal or after you have reviewed your next paycheck.

- Form W-4 Creator: Create, Fill-out Form W-4: Online tool to complete, fill-out a W-4 without any additional calculations, suggestions.

- PAYucator based W-4: Create Form W-4 based on your Paycheck. Complete, adjust your paycheck and the tool will create a Form W-4 based on your paycheck results.

Below are links that explain the W-4 in more detail.

What is a Form W-4 - Video?

How to complete a W-4?

Types of W4 Forms

W4 Tax Withholding Calculator

W-4 withholding examples

Is a Large Tax Refund a Self Imposed Penalty?

Create, Complete your Form W-4

What is needed to Complete a Form W-4?

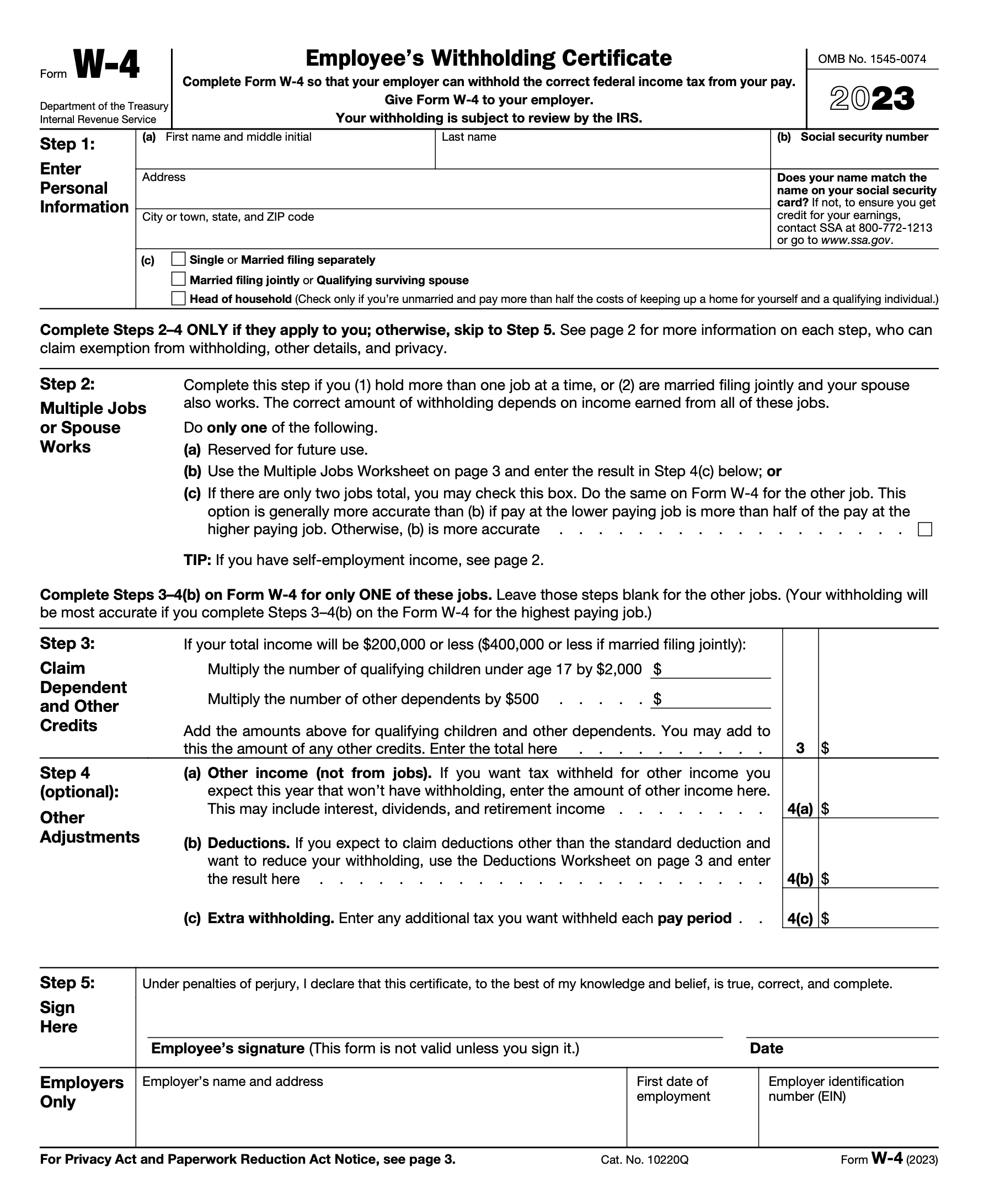

Form W-4: Step 1 Image

Name, Address, SSN

Step 1

Your current address does not have to match your tax return address

Tax Return Filing Status

Step 1

Single, Married, Surviving Spouse (previously qualified widow[er]) or Head of Household

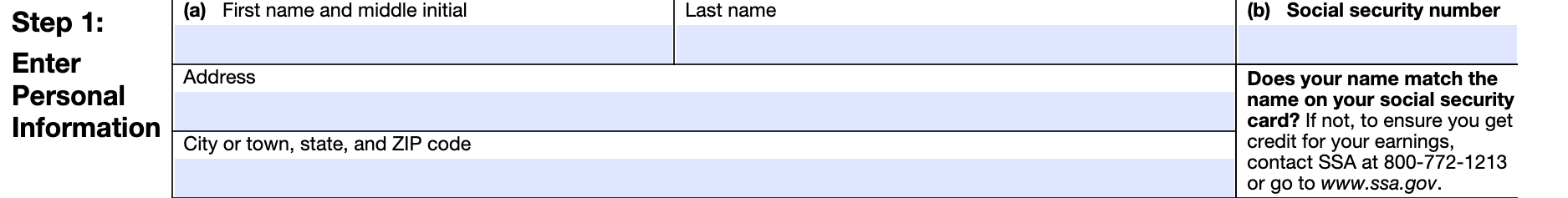

Form W-4: Step 2 Image

Number of Jobs

Step 2

If you only have one job, leave the checkbox under c blank. Mark the checkbox if you either hold more than one job at a time, or you are married and filing jointly with a spouse who also has a job. Logically, this means that together you have 2 jobs and this should be marked as such. The correct amount of withholding depends on the income earned from all of these jobs. If there are 2 jobs in the household, enter Dependents and/or Deductions on the W-4 with the highest income. Do not enter the Dependents/Deductions on each of the two W-4 forms.

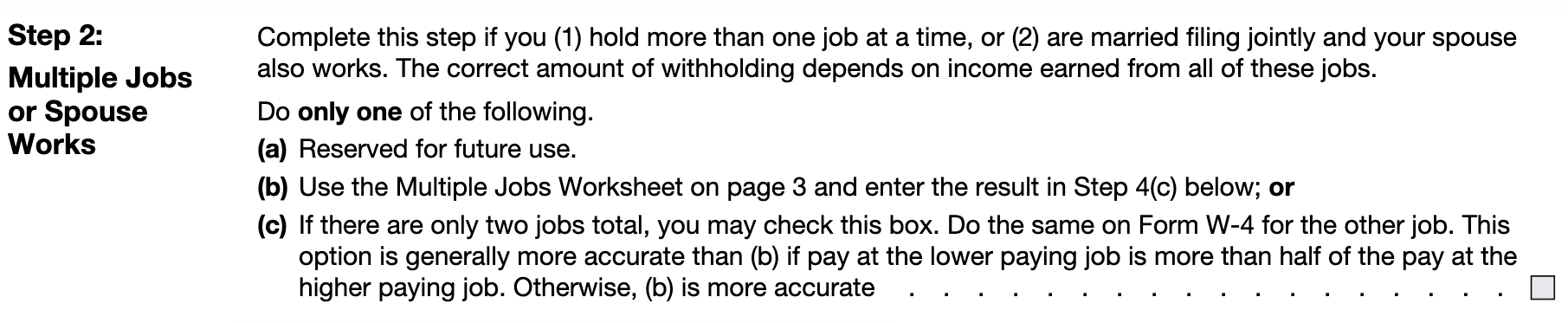

Form W-4: Step 3 Image

Dependents

Step 3

If you do not have Dependents, you can leave this blank. Otherwise, enter the number of your

qualifying dependents and other dependents (e.g.

qualifying relatives) you could claim on your tax return. If there are 2 jobs in the household, enter the Dependents ONLY on the W-4 with the highest income. Leave the second W-4 blank in Step 3.

Tip: An increased number of dependents would decrease your IRS tax withholding for each pay period. A decreased number of dependents would increase your IRS tax withholding.

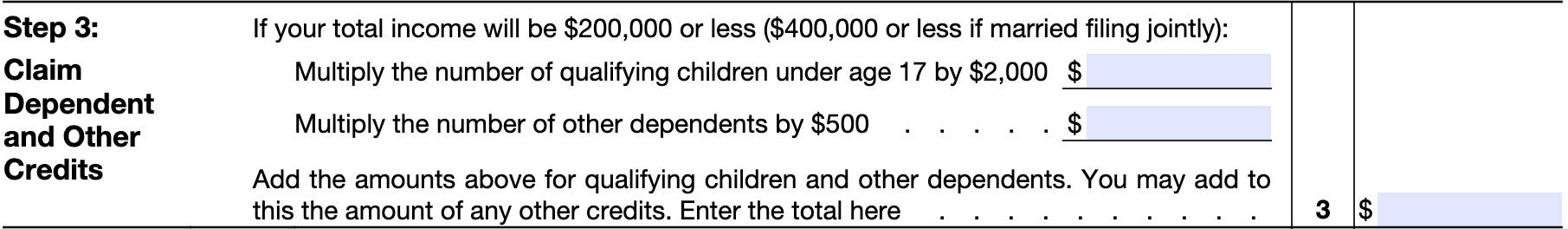

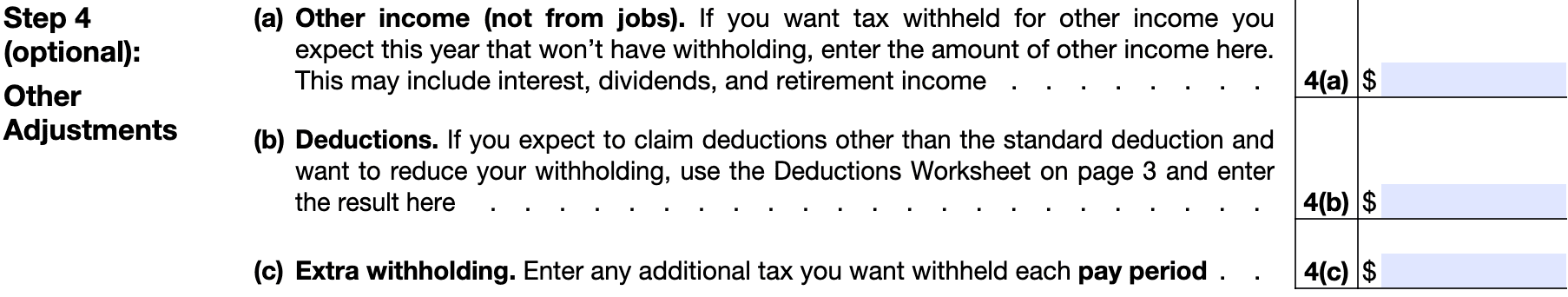

Form W-4: Step 4 Image

(a) Other Income

Step 4

(Optional) Only add this if you have other income and you wish to have taxes withheld for this income. If you are already withholding taxes for this income leave this blank.

(b) Deductions

Step 4

(Optional) Enter expected tax deductions for the given tax year. Do not list the

standard deduction here. Generally, you would enter an amount here that would exceed your standard deduction and you selected to

itemize your deductions on your next tax return.

Tip: An increased deduction amount would decrease your IRS tax withholding for each pay period. A decreased deduction amount would increase your IRS tax withholding.

(c) Extra Withholding

Step 4

(Optional) Add a dollar amount of extra income taxes you want to have withheld through your paycheck.

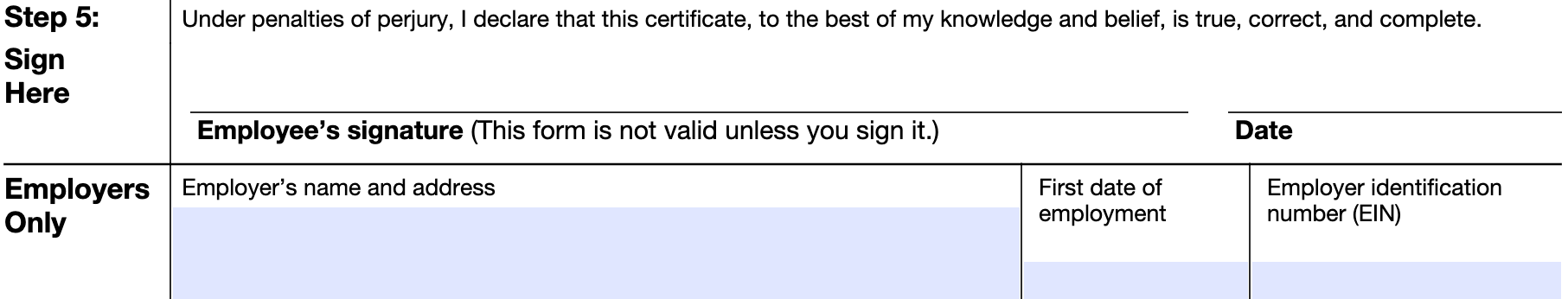

Form W-4: Step 5 Image

Signature, Date

Step 5

Sign the Form and enter the date, which would be either the day you're signing the document or the effective date of the Form W-4

Ways to Calculate and Create a W-4

W-4 Creator

Create, sign, and distribute your Form W-4 without any prior tax estimate calculations. Use this tool if you already know what to enter on the Form W4.

Start the W-4 Creator

Paycheck Calculator

Determine your Tax Withholding Amount based on your paycheck-based income, the number of dependents, and the deductions you entered. Based on the result, create your W-4 and manage your tax withholding for the remainder of the year.

Start the Paycheck Calculator

Income Tax Rate

This calculator, or RATEucator, will estimate your annual Federal Income Taxes based on your total annual income. Based on the result, create your W-4 and manage your tax withholding for the remainder of the year.

Start the RATEucator

Tax Calculator

This calculator, or TAXstimator, will estimate your tax return for this year which will be due next year. Based on the result, create your W-4 and manage your tax withholding for the remainder of the year.

Start the TAXstimator

State Income Taxes

This calculator, or STATEucator, will estimate your annual State Income Taxes based on your total annual income. Based on the result, create your W-4 and manage your tax withholding for the remainder of the year.

Start the STATEucator

Taxpert®

Discuss your W-4 questions and goals with a Taxpert for free and we will guide you through the process.

TurboTax® is a registered trademark of Intuit, Inc.

H&R Block® is a registered trademark of HRB Innovations, Inc.