IP PIN on Your Upcoming Tax Return

Learn how to obtain an IRS IP PIN or Identity Protection Personal Identification Number for you, your spouse, and/or your dependent(s). Getting an IP PIN provides an extra layer of security for your identity when filing a tax return. A dependent IP-PIN would prevent unauthorized individuals, such as an ex-spouse, from claiming your qualified dependents on their taxes. See more details on wrongly claimed dependents.

Lincoln, USA

@noahbuscher

If you have an IP-PIN for the current tax year, see instructions:

A: How to enter your and/or spouse's IP-PIN on eFile.com.

B: How to enter an IP-PIN for your dependent(s) on eFile.com.

How, Where, and When to Obtain an IP-PIN

- Get IRS IP-PIN(s) for free for you, your spouse, and/or dependent(s) from your IRS account; you will need to create an IRS account for each SSN

- When to obtain an IP-PIN? Starting mid-January, you can obtain a new IP-PIN to file the current year tax return.

- An IP-PIN is only good for one tax return year and you need to get a new IP-PIN each tax year - the IRS is supposed to send these automatically via letter in the mail, but you may need to retrieve it if you do not receive it.

- During the year, you will have the option to opt-out from the IP PIN program.

- See instructions on how to enter the IP-PIN on eFile.com.

- An incorrectly entered IP PIN on an electronically filed tax return or extension will result in a temporary rejection. This can be corrected by entering the correct IP PIN and re-efiling at no charge. What to do if the IRS rejected your return for an invalid IP PIN?

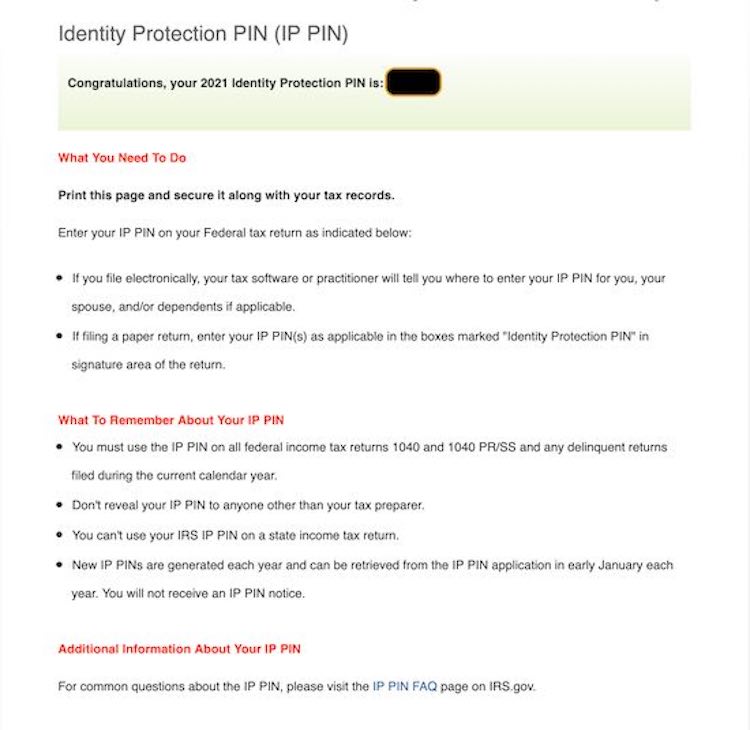

What Is an IP-PIN?

An IP PIN - Identity Protection Personal Identification Number - is a 6-digit code known only to you and the IRS which assures no one can file your tax return under your SSN without it. During e-filing, you will enter the IP-PIN and ONLY if this IP-PIN matches IRS records will the IRS accepted your return.

This extra IP-PIN layer would prevent someone else from filing a tax return with your SSN, thus the IP-PIN will help you protect yourself from others so nobody can fraudulently mistakenly e-file an

income tax return with your SSN.

Tip: For your own tax data protection,

eFile.com strongly recommends taxpayers obtain a personal IP PIN, store it in a safe location, and do not share it with anybody. Enter this IP PIN during the

e-filing and checkout process.

Important: When e-filing your next return, use these key points to e-file successfully and avoid rejection:

- Enter all your IP PINs for you and your family. If you and/or your spouse have an IP PIN, enter this when you e-file your return on eFile.com. If your dependent or dependents have IP PINs, enter these on the dependent screen within your eFile account.

- The IRS issues an IP PIN each year, thus, your IP PIN last year is no longer valid. The IRS should issue you Notice CP01A with your IP PIN; otherwise, you will need to retrieve your most recently issued IP PIN.

- You can retrieve this online using the resources below.

- The IRS-issued IP PIN and your five-digit signature PIN are two separate numbers. Your PIN is one you create which acts as an electronic signature on your return; the IRS IP PIN is used for identity verification.

If you are rejected, you can re-file your return at no extra cost once you retrieve your IP PIN.

How to Apply for an Identity Protection PIN

When you prepare and eFile your taxes on eFile.com, you will be asked if you have an IP-PIN during checkout. If you do have an IP-PIN, answer with "Yes" and follow these IP-PIN checkout steps. If the IP-PIN you entered does not match the one on record, the return will be rejected. At that point, you can re-enter the IP-PIN or retrieve the correct one. Only the taxpayer with the IP-PIN will be able to e-file the return.

Before you apply for your personal Identity Protection PIN, review these points:

- A primary taxpayer, secondary taxpayer (spouse), or a dependent can obtain an IP-PIN upon proof of identity. Any taxpayer who can properly verify their identity is eligible for the Opt-In Program to obtain an IP-PIN.

- Prove your identity via a valid Social Security Number (SSN) or an Individual Tax Identification Number (ITIN).

- The IP PIN is only valid for one year and must be renewed annually which the IRS should handle for registered taxpayers automatically.

- If it is not automatic, you will need to retrieve it if you do not receive it for any reason.

- Applying online for the IP PIN is fast and secure. In addition, it is the only method to obtain the IP PIN immediately available to the taxpayer.

- Taxpayers who voluntarily apply or opt-in to the IP PIN program do not need to submit Form 14039 - Identity Theft Affidavit.

Get IRS IP-PIN(s)

It's free for you, your spouse, and/or dependent(s) from your IRS account.

You will need to create an IRS account for each SSN holder.

Tax Return Instructions:

A: How to enter your and/or spouse's IP-PIN on eFile.com.

B: How to enter an IP-PIN for your dependent(s) on eFile.com.

Get Your IP PIN Offline

- For obtaining a new IP-PIN: Taxpayers with income of $72,000 or less can complete Form 15227, IP PIN Application and mail it to the IRS address listed on the form. Once the IRS has received the form, the taxpayer will receive a call from the IRS to verify the personal identity. Once completed and passed, the taxpayer will receive an IP PIN for the next filing season.

- Taxpayers who can't apply online or are not eligible file Form 15227 can make an appointment with a Taxpayer Assistance Center. The taxpayer has to provide two forms of picture identification. Once the taxpayer passes the authentication, an IP PIN will be mailed to the taxpayer.

- For retrieving your assigned IP-PIN: If there is any trouble creating an IRS Account (no credit card or loan to verify identity, etc.), there are alternatives. Taxpayers can call the IRS at 1-800-908-4490 for assistance with this. The IRS will help verify your identity and mail your most recently generated IP-PIN to the address they have on record within 21 days.

If a taxpayer is unable to electronically file their return without this and cannot get their IP-PIN in time, they may have to mail in their tax return as this will not require the IP-PIN.

Taxpayers should store the IP PIN in a safe location and not share their personal PIN with anyone but their tax provider. The IRS will never ask for your IP-PIN; any phone call, email, or text asking for your IP-PIN is a scam.

Using Your IP-PIN when Filing or e-Filing Your Tax Return

When you file your taxes with eFile.com, you will enter your IPPIN during the process. This will quickly and easily verify your identity and allow your return to be processed and get your tax refund to you, if owed. Be sure to enter it correctly on the first attempt in order to avoid any errors or rejections. Obtain your PIN from your IRS account or a letter sent from the IRS.

Common questions when using your IP-PIN:

- What if I enter my IP PIN incorrectly? The IRS will reject the return temporarily. Login to your eFile account and attempt to refile using the correct IP-PIN. If you are certain the number entered is correct, review it on your IRS online account, contact one of our Taxperts®, or call the IRS to reissue an IP-PIN at 1-800-908-4490 for specialized assistance.

- How do I use my IP PIN on a joint return? If you are married filing jointly, you will enter your IP PIN as if you were filing single if you have one. If you and your spouse both have one, enter it on your return under the same tax filing status. If only one of you has one, only that spouse will have to enter it. If you're unsure of your status, see this free and easy STATucator to get your IRS filing status.

- Where do I enter my IP PIN when filing my tax return? The eFile Tax App will prompt you to enter your IP PIN during checkout. If you are having trouble finding where or how to enter your PIN, contact one of our Taxperts®.

- Do I have to use my IP PIN to file previous year returns? No, previous year returns or back taxes cannot be e-filed. Because of this, an IP PIN is not needed.

- How long is my IP PIN good for? Each IP-PIN is valid for one year; the IRS will issue a new one each year. You may apply for one via the instructions above or the IRS may send you Letter CP01A with your new IP-PIN sometime in late December or early January.

- Should I get rid of my IP PIN after I have filed? Keep your IP-PIN in a safe location for the entire year, even if you have already used it. After you have received a new one for the new year, it is safe to dispose or delete the old one, but we recommend keeping it for your records.

- How do I use my dependent's IP PIN on my tax return? If you claim a dependent on your tax return and they have their own IP-PIN, you will enter this when you e-file your return. The eFile Tax App will help you with this when applicable.

- What forms do I use my IP PIN on? The IP-PIN is only used on the following 1040 forms: 1040, 1040-SR, 1040-NR, and 1040-PR/SS. This means you will not use your IP-PIN when filing a tax amendment or tax extension.

- Will I get my tax refund faster by using an IP PIN? Using your IP-PIN does not determine how or when you will receive your refund, if owed. See our free DATEucator to estimate your tax refund date.

Additional questions? Our Taxperts® are here to help.

Tax-Related Identity Theft Victims

Confirmed victims of tax-related identity theft should file a Form 14039, Identity Theft Affidavit, if their e-Filed tax return got rejected due to a duplicate SSN. The IRS will then investigate their case and, once the fraudulent tax return is removed from the taxpayer's account, the taxpayer will automatically receive an IP PIN by postal mail at the start of the next calendar year or tax season.

Confirmed identity theft victims can't opt out of the IP PIN program unlike other taxpayers. IP-PINs will be mailed annually to confirmed victims and participants enrolled before the end of the year. This comes in the form of a CP01A Notice which will contain the PIN.

Lost IP-PINs can also be retrieved via the online account.

Review IRS identity theft information for taxpayers.

Register Account, Get IP PIN

Prepare your tax return with eFile.com and use your IP-PIN to verify your identity. See the ways eFile practices security for user data.

Learn about fake IRS emails and how to handle identity verification through an IRS letter you received.

TurboTax® is a registered trademark of Intuit, Inc.

H&R Block® is a registered trademark of HRB Innovations, Inc.