Home Mortgage Deduction, Interest Expenses

The Home Mortgage Interest Tax Deduction is an itemized deduction you can claim on your tax return for home mortgage interest you paid during the tax year. Home mortgage interest is amounts you pay on a qualified residence loan for a main or second home. A qualified residence loan is a mortgage you use to buy a home, a second mortgage, a line of credit, a home equity loan, or a home equity line of credit. You can itemize your deductions on your return if they are more than your standard deduction. Otherwise, it is not tax advantageous to you.

The easiest and most accurate way to find out if you can deduct home mortgage interest tax payments is to start a free tax return on eFile.com. You can provide your mortgage interest information from your Form 1098 and we will determine whether or not it is best for you to itemize your deductions and claim the tax deduction on home mortgage interest payments. See more details and criteria below.

Related:

Mortgage Deduction Requirements

Generally, your home mortgage interest is tax deductible up to $750,000. For most taxpayers, this means your entire mortgage interest is able to be deducted from your taxable income. You can deduct your home mortgage interest payments based on these factors:

- The mortgage date

- The mortgage amount, and

- How you use the mortgage amount.

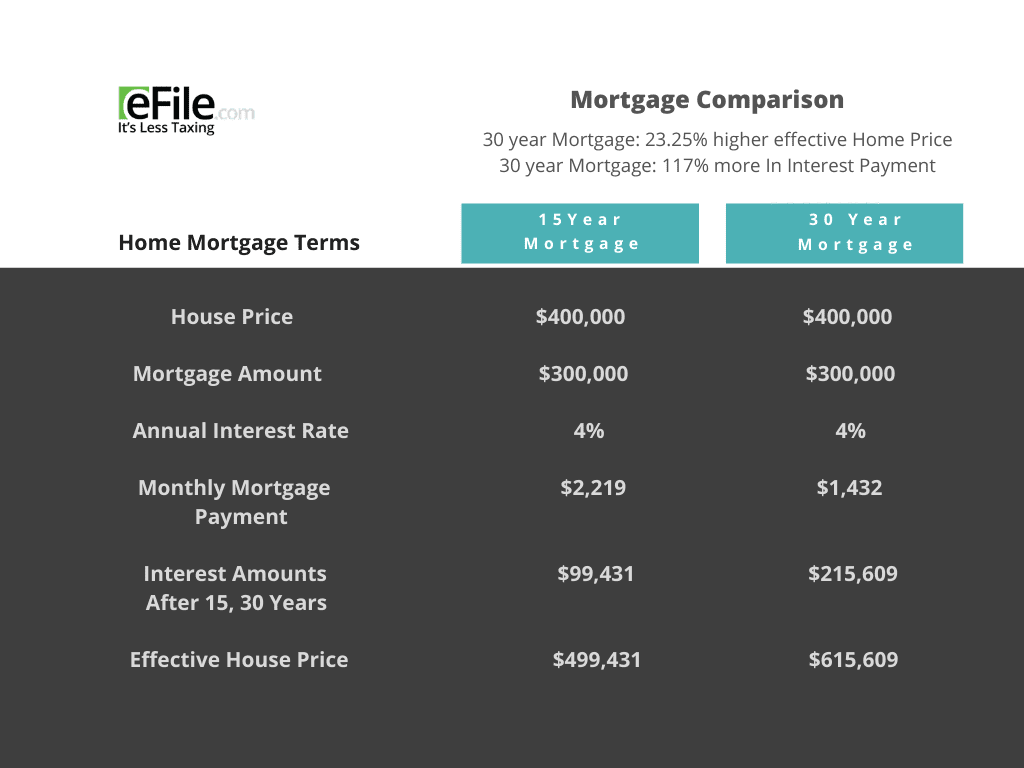

Compare Mortgages: 15-year versus 30-year mortgage.

The mortgage interest deduction is able to be claimed for your primary residence or a home you live in. You may also be able to deduct interest paid on a second home, such as a vacation or rental home, under certain criteria. For example, if you rent a home for less than 14 days per year, you can claim the deduction. This can be if you use a lake house as a second home that you visit in the summers which you do not rent out for more than two weeks in a year. If you rent out property all year, then you can deduct mortgage interest as a business expense via eFileIT Schedule C and Schedule E , which could be worth up to $15,000 if your property earned you $50,000 in rental income for the year.

The Home Mortgage Interest Tax Deduction can only be claimed if you itemize on your tax return - that is, when your itemized deductions are greater than your standard deduction and you file a Schedule A. Your standard deduction is a fixed amount you can deduct based on your tax return filing status. Itemized deductions are not a fixed amount-they are the total deductions that are listed on your eFileIT Schedule A.

Can I claim my mortgage insurance points as a deduction and itemize all my deductions together?

Yes, if your itemized deductions are larger than your standard deduction, you can itemize deductions. If you have expenses for the following, it may be worth itemizing your deductions:

Since the standard deduction for 2018 and later Tax Returns almost doubled due to tax reform and the Tax Cuts and Jobs Act (see table below), it will not be beneficial for most taxpayers to itemize on their returns and the changes to the Home Mortgage Interest Tax Deduction will not affect them. When you prepare your return on eFile.com, whether it is better for you to itemize or use the standard deduction is figured out for you, so you don't have to worry which one is better for you.

Qualified Residence Loan Amount Limits

You can deduct the mortgage interest you paid up to a certain amount of your total qualified residence loan amount. The amount is based on your filing status and the year you purchased the mortgage. You may refinance the existing mortgage and keep deducting the interest up to the amount based on your filing status as long as you do not increase the amount you owe with the refinance.

Below are the amounts for mortgages purchased between 2018-2025:

Married Filing Jointly/Qualifying Widow

$750,000

Head of Household

$750,000

Married Filing Separately

$375,000

If you signed your mortgage agreement before 2018, the limit is increased. These are the grandfathered amounts for mortgages purchased before 2018 (you may claim these amounts on 2018 - 2025 Tax Returns if you purchased the mortgage before 2018):

Married Filing Jointly | Qualifying Widow

$1 million

Head of Household

$1 million

Married Filing Separately

500,000

Because the limits are so high, many taxpayers will find that they can deduct their entire mortgage interest on their taxes if they benefit from itemizing their deductions.

What kind of mortgage should I take?

Refer to this simple chart on how to save money on your mortgage. Depending on your personal situation, you may benefit from taking a 15-year mortgage and paying off your home sooner rather than a 30-year mortgage.

15 year mortgage versus 30 year mortgage comparison:

Taking out a shorter-term loan will result in less interest since you pay if off faster than a long-term loan. If it is possible based on your financial situation, consider taking on a shorter plan; you could save over $100,000 when you take a 15-year mortgage instead of a 30-year one.

Home Equity Loans and Lines of Credit

For home equity loans incurred after December 15, 2017, you cannot deduct interest on the debt unless it is used to buy, build, or improve your home that secures the debt. Your interest deduction is limited to debts up to $750,000 (married jointly filers) or $375,000 (married filing separately). Home equity loans incurred on or before December 15, 2017 are grandfathered into the old $100,000 debt limit and the interest deduction can be applied to non-home expense payments (college tuition, credit card debt, etc.). We recommend that you compare a 15 year mortgage versus a 30 year mortgage and the implications on the effective home price over time.

Tomáš Malík, Unsplash

@malcoo

Mortgage Insurance Premiums

The tax deduction for mortgage insurance premium payments was extended through 2021, but the deduction is no longer applicable as it has expired. When you prepare and e-file your next tax return on eFile.com, you will not see the deduction on your return as eFile only uses current IRS data so you do not accidently claim deductions no longer in effect.

For previous years, if you can't make a down payment of 20%, then the lender may require you to pay private mortgage insurance or PMI. If your adjusted gross income or AGI is $100,000 or less ($200,000 for married filing jointly), you can take deduct the interest paid as an itemized deduction on Schedule A. If you make over this amount, it is deductible at a phased out amount up to $109,000 (or $218,000).

If you already filed your previous year return and want to claim your mortgage insurance premiums, you will need to prepare and file an amended tax return. If you still need to file back taxes, find all previous year tax forms.

Is There a Tax Credit for Mortgage Insurance Premiums?

The IRS offers a federal tax credit for mortgage insurance premiums via Form 8396 - eFileIT. This credit can be claimed if you were issued a mortgage credit certificate or MCC by a state or local government agency. As a homeowner, you can claim this credit when you file your federal tax return and it is generally geared towards lower or moderate income earners often to help with the purchase of a new residence through a mortgage. This credit is nonrefundable, meaning it can only be used to offset any tax liability, but it does carry forward for three years. For instance, you could use the maximum credit amount of $2,000 over two years, paying your tax liability on your return of $1,000 each year to lower your taxes and maximize your tax savings.

When claiming the credit, the eFile Tax App will offset your mortgage interest deduction on your return since these are two separate tax items. You can clam both, but the credit reduces the deduction. Enter your mortgage insurance premium information on Form 1098 in your eFile account and answer the related questions to see if you qualify for the credit and/or deduction.

Mortgage Points

Mortgage points are a form of prepaid interest you can choose to pay up front in exchange for a lower interest rate and monthly payments (or otherwise known as “buying down” your interest rate). You can deduct all your points as mortgage interest in the year you pay them if you meet all of these requirements:

- You use a loan to build or buy your main home.

- Your main home secures your loan.

- Paying points is an established business practice in the area where the loan is created.

- The points you paid were not more than the loan amount usually charged in that area.

- You use the cash method of accounting and you report income in the year you receive it and deduct expenses in the year you paid them.

- The points you paid were not for items usually listed separately on a settlement sheet (such as appraisal fees, inspection fees, and property taxes).

- The funds you provided before or at closing (including seller paid points) were at least as much as the points charged. Be aware that you cannot have borrowed the funds from your mortgage broker or lender in order to pay the points.

- The points were calculated as a percentage of the main amount of the mortgage.

- The amount is clearly shown as points on your settlement statement.

There are two types of mortgage points: discount and origination.

Discount Points

Discount points are fees you may pay upfront to lower the interest rate on a mortgage loan. Each point is equal to one percent of the loan amount (one point equals $1,000 for every $100,000 of the loan amount, so one point on a $250,000 loan is $2,500). Therefore, the more points you pay, the less you pay on your interest rate (usually by 0.25%) and monthly loan payment.

Your discount points are deductible when you rent out a main or second home if:

- The mortgage is obtained to build, buy, or improve the home (and the home is the collateral for the loan) and

- The money you use to buy the points is paid directly to the lender (not borrowed).

For example, George borrows a $100,000 mortgage with a 5% interest rate, making his monthly payment $537. When he purchases three discount points, his interest rate goes down to 4.25%, making his new monthly payment $492.

However, the upfront costs of taking out a mortgage may increase when you purchase points. Therefore, if you plan to sell or refinance your home before a break even point, it may not be best for you to buy points. In George's case, the three discount points he purchased would cost him $3,000 in exchange for saving $45 a month, so he would need to keep his home for 66 months (or 5 and a half years) to break even on his point purchase.

Origination Points

Origination points are required fees you pay to a loan leader (either upfront or throughout the the life of the loan) to cover the lender's costs of creating and processing a loan (i.e. fees charged by loan officer or broker and others who work to execute the loan). Each origination point is 1 percent of the total loan amount.

Your origination points can be claimed as a depreciation expense in the year you borrow the loan or over the lifespan of the loan, depending on how the points are paid. Be aware that the points are non-deductible on non-rental properties.

Deductible and Nondeductible Examples

Home Mortgage Interest Payments

- In February, Jack and Jill take out a $500,000 mortgage to purchase a main home at a fair market value of $800,000. In March of the same year, they take out a $250,000 home equity loan to include an addition on the main home. Since the total amount of both homes do not exceed $750,000 and they do not exceed the cost of the home, all the interest they paid on the loans is deductible. However, if they use the home equity loan to pay for personal expenses (i.e. pay off credit card debt and/or student loans), then the interest on the home equity loan is not deductible.

- In January, Mary and Bill take out a $400,000 to purchase a main home. In July, they take out a $150,000 loan to purchase a vacation home. Since the total of both mortgages do not exceed $750,000, all the interest they paid on both mortgages can be claimed as a tax deduction.

- In July, Josh borrows $50,000 to remodel his kitchen and bathroom. In November of the same year, he takes out a $100,000 loan to upgrade his living room. He can deduct the total amount of interest he paid on the home improvement loans throughout the year.

Mortgage Points

- Sara pays $4,000 in points and will make 360 monthly payments on a 30-year loan. This makes her allowable deduction $11.11 per payment (or $133.33 for 12 payments).

- Jeremy purchases $3,600 in points on a 30-year loan to buy a vacation home. He deducted a total of $540 in points on his prior year tax returns, then he sold the home. This means that he can claim a deduction on $3,060 in points on his tax return for this year ($3,600 minus the $540 he previously deducted).

- Bella and Edward refinanced their $200,000 loan with a new 30-year $250,000 mortgage. During the tax year, they paid $2,000 in points and used the extra $50,000 to make home improvements. They can claim a 20% deduction of $400 ($50.000/250,000 x 2,000) of points on their next tax return. They must deduct the remaining points over 360 monthly payments or $53.28 ($1,500/360 x 12) per year.

Learn more about Home Mortgage Interest Deduction in IRS Publication 936.

How to Claim the Tax Deduction or Credit

When you prepare your tax return on eFile.com, you can enter your Home Mortgage Interest information on the Mortgage Interest - Form 1098 screen. We will calculate the deduction amount for you and report it on Schedule A of your return. Schedule A will automatically be generated based on the information you enter on the Mortgage Interest - Form 1098 screen. If claiming the credit, we will walk you through questions and fill in Form 8396. Do IT all on eFile.com.

Additional home related pages and documents

TurboTax® is a registered trademark of Intuit, Inc.

H&R Block® is a registered trademark of HRB Innovations, Inc.