Job Tax Deductions, Employee Claim

Employee Job

Tax Deduction

One of the results of the Tax Cuts and Jobs Act was removing the deduction for un-reimbursed employee business expenses until 2026 Tax Returns. This means that employees can no longer reduce their taxable income by deducting employee business expenses (as listed below) or job search expenses. Overall, most taxpayers might actually fair better with the higher standard deductions compared to the previous employee expense tax deductions. For 2020 and previous year returns, employees can deduct unreimbursed expenses which they paid for during the year.

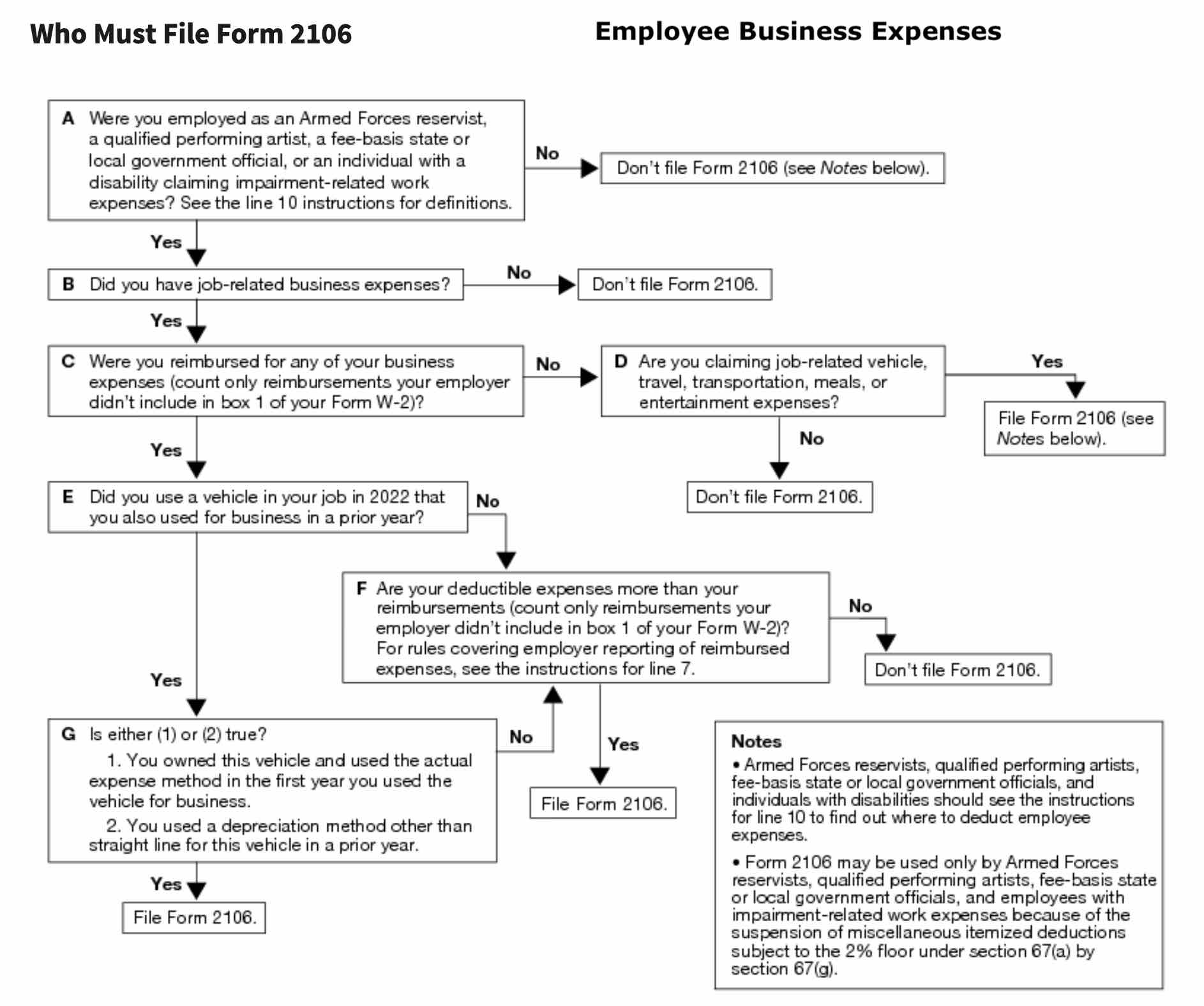

View the chart below, whether you qualify for Employee Business Expense deductions via Form 2106, as this form generally only applies to reservists in the Armed Forces, qualified performing artists, fee-basis state or local government officials, and employees with impairment-related work expenses.

Deductions to Claim as an Employee

The information below applies to W-2 employees who may have unreimbursed expenses from their job. This does not apply for 1099 employees or the self employed as deductions for this work still apply. See also: what is a 1099 employee versus statutory employee versus W-2 employee?

As stated, many tax deductions have been eliminated or replaced with the increased standard deduction. This was greatly increased to make it easier for taxpayers to claim deductions and reduce their taxable income. With that, claiming itemized deductions has changed. Overall, to decide on whether the itemized versus standard deduction method is best for you can be challenging. However, when you prepare your 2022 Taxes with eFile.com, there is no need to memorize these changes. The eFile App will select the deduction method that benefits you the most. Having said that, you can still select in the eFile Tax App which method you prefer. Furthermore, the tax app will select tax credits you may be entitled to when you prepare your tax return on eFile.com.

Non-Deductible Employee Expenses

You can only deduct certain employee business expenses in 2022 - the majority of these expenses are not tax deductible, but there are certain employment categories which may qualify.

As it stands now, the following employee or job related deductions CANNOT be applied with your 2022 Return, but are scheduled to return beginning with 2026 Returns. Keep in mind, if any of these expenses occur during your employment, you might want to ask your employer if you can get these fees re-reimbursed by them:

- Appraisal fees for a casualty loss or charitable contribution

- Casualty and theft losses from property used in performing services as an employee - information on Casualties, Disasters, and Thefts

- Clerical help and office rent in caring for investments

- Credit or debit card convenience fees

- Depreciation on home computers used for investments

- Excess deductions (including administrative expenses) allowed a beneficiary on termination of an estate or trust

- Fees to collect interest and dividends

- Hobby expenses, but generally not more than hobby income

- Indirect miscellaneous deductions from pass-through entities

- Investment fees and expenses

- Legal fees related to producing or collecting taxable income or getting tax advice

- Loss on deposits in an insolvent or bankrupt financial institution

- Loss on traditional IRAs or Roth IRAs, when all amounts have been distributed to you

- Repayments of income

- Repayments of social security benefits

- Safe deposit box rental, except for storing jewelry and other personal effects

- Service charges on dividend reinvestment plans

- Trustee's fees for your IRA, if separately billed and paid.

The above must be used to produce gross income, to manage property for producing said income, and/or to determine a tax refund.

Additionally, the following are job-related expenses that were non-deductible in past years and will remain non-deductible for 2022:

Commuting Expenses: You cannot deduct commuting expenses for transportation between your home and your regular place of work. If you carry tools, instruments, or other items in your car to and from work, you can deduct only the additional cost of transporting the items, such as the rent of a trailer to carry them. Self-employed individuals may be able to deduct mileage if they travel for work.

Lobbying Expenses: Expenses paid for lobbying activities cannot be deducted.

If an organization is tax-exempt and part of the dues or other amounts you pay to the organization are used to pay nondeductible lobbying expenses, you cannot deduct that part. Here are exceptions to this:

- You can deduct ordinary and necessary lobbying expenses of carrying on your trade or business.

- Expenses for efforts to influence the legislation of any local council or similar governing body such as an Indian tribal government can be deducted.

- Generally, you can deduct the expenses for the trade or business of lobbying on behalf of another person if you are a professional lobbyist. Payments by the other person to you for lobbying activities cannot be deducted.

Meal Expenses: You cannot deduct the cost of lunches with co-workers or when working late, except while traveling away from home on business. If you are self-employed, you may be able to deduct meals as business expenses.

Professional Accreditation Fees: The cost of professional accreditation fees such as the following cannot be deducted:

- Accounting certificate fees paid related to practicing accounting

- Bar exam fees and incidental expenses

- Medical and dental license fees.

Tax-Exempt Income, Expenses of Earning or Collecting: If you have expenses to generate tax-exempt income, you cannot deduct the interest owed on a debt used to acquire or continue to purchase tax-exempt securities. If you cannot determine which expenses were used to generate taxable and tax-exempt income, you need to divide them based on the amount of each type of income to determine the amount you can deduct.

Non-Deductible Expenses: If your employer provides you any of the following, it will generally be considered taxable income. Furthermore, these expenses do not qualify as deductible:

- Commuting expenses

- Health spa expenses or membership fees

- Political contributions

- Campaign expenses

- Brokers' commissions

- Meals while working late

- Lunch with co-workers (except while traveling)

- Professional accreditation fees

- Professional reputation, expenses to improve

- Club dues

- Life insurance premiums

- Personal disability insurance premiums

- Burial and funeral expenses

- Personal legal fees

- Fines, such as parking and speeding tickets

- Interest on car loans

- Capital expenses

- Check-writing/personal checking account fees

- Home repairs, insurance, and security

- Fees for licenses, such as for marriage

- Lost or misplaced cash or property

- Relief fund contributions

- Residential telephone lines

- Wristwatches (even if necessary for work)

- Voluntary unemployment benefit fund contributions

- Lost vacation time or unpaid wages

- Expenses of earning and collecting tax-exempt income

- Expenses of attending a stockholders' meeting.

See employee tax deductions that you may be able to claim under certain circumstances. Instead of worrying about what deductions you can claim, prepare your taxes on eFile.com and let the tax app help you keep more of your hard earned money.

TurboTax® is a registered trademark of Intuit, Inc.

H&R Block® is a registered trademark of HRB Innovations, Inc.