How to Enter Form 1099-R

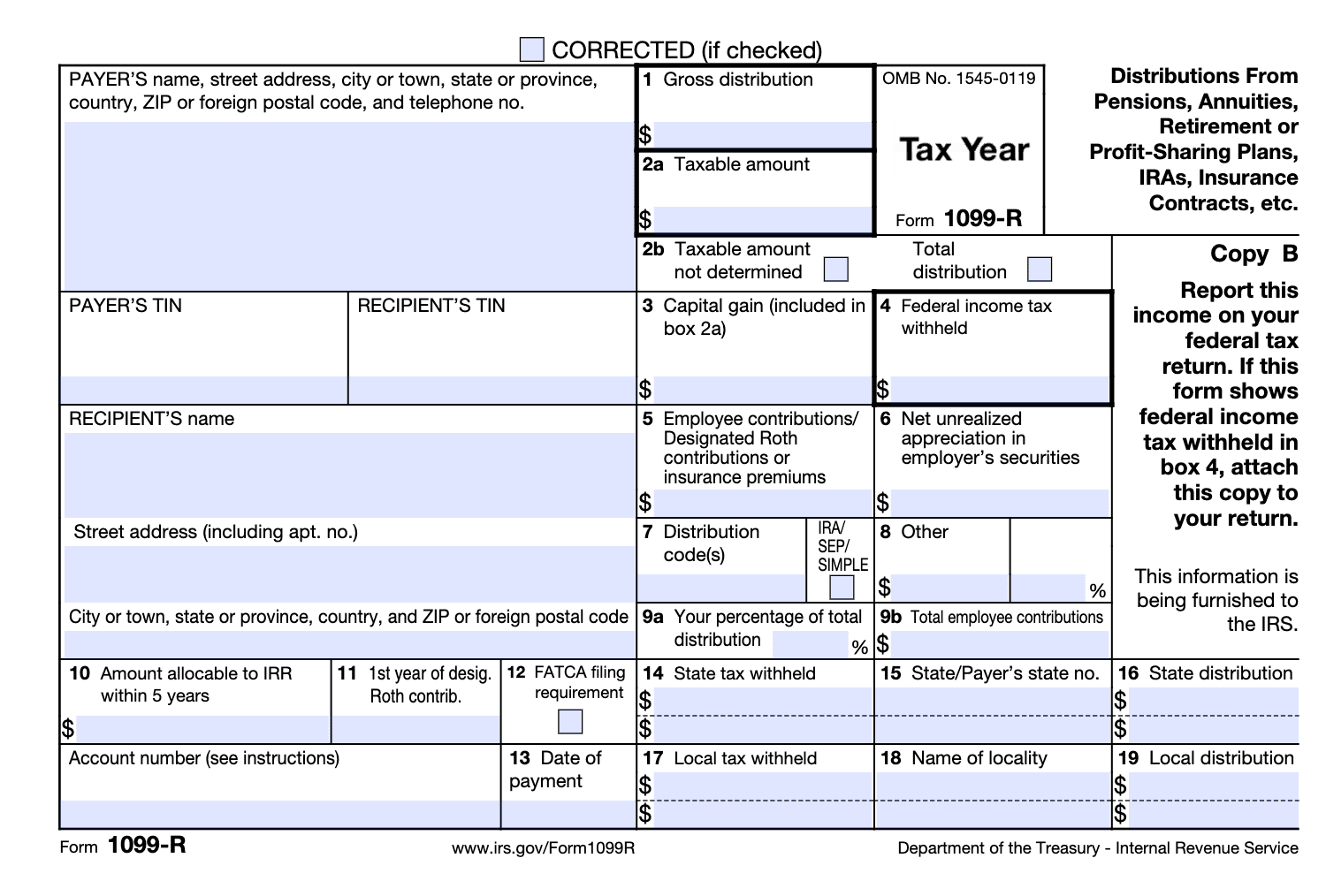

Are distributions from retirement or profit-sharing plans, pensions, annuities, IRAs, insurance contracts, etc., taxable? How do you add 1099-R to your return? Detailed overview, instructions of Form 1099-R and 5498:

When you receive a 1099-R reporting retirement income, you will likely need to add it to your tax return. When you add this form to your eFile account, the tax app will determine any income taxes based on your entries. Follow the steps below to add your 1099-R.

Step 1: Sign in to eFile.com and select Federal Taxes on the left menu.

Step 2: Then select Income below and on the right side, scroll to Retirement and select Tell us about your Retirement.

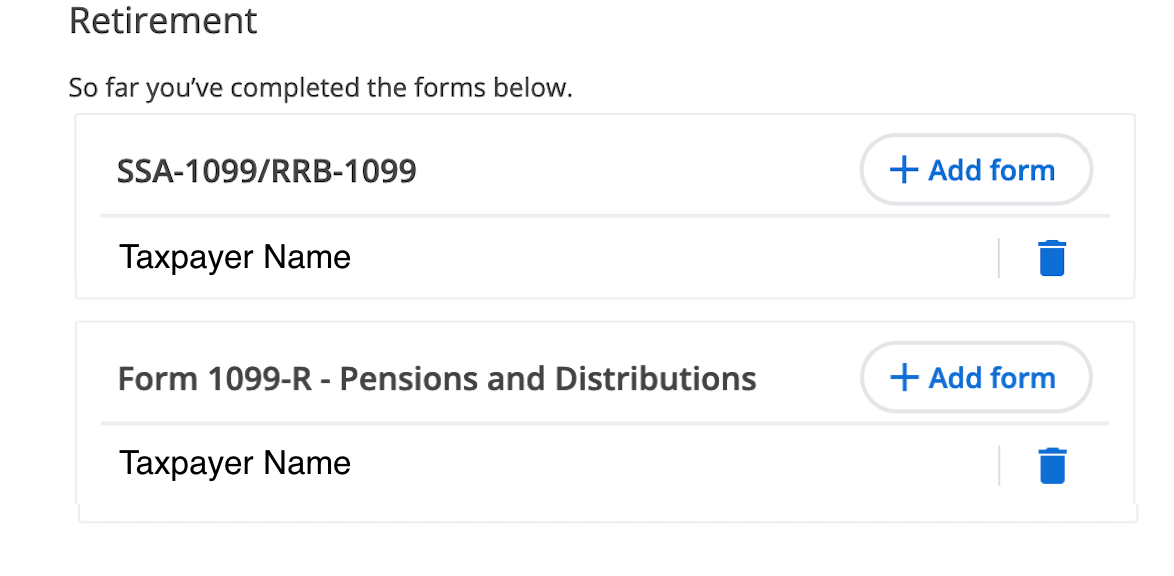

Step 3: Take the retirement interview and have your Form 1099-R handy. The tax app will either create Form SSA-1099/RRB-1099 or 1099-R - Pensions and Distributions based on which form you select. Be sure you answer "Yes" to the question regarding the form you have so you can enter all your information correctly.

Exceptions or Additional Information:

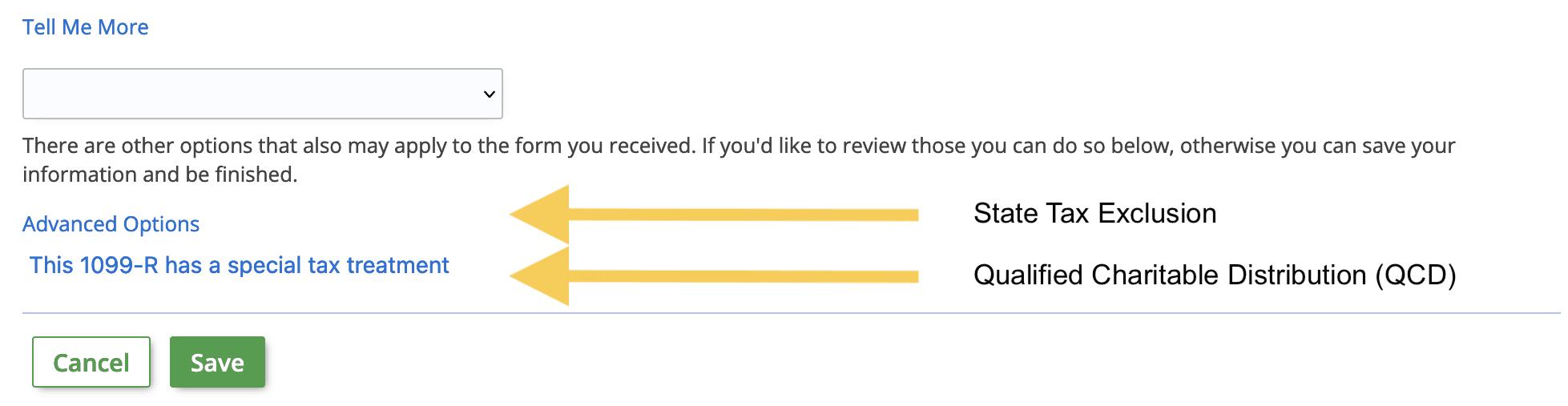

You may need additional options for entries based on your 1099-R. Use these two paths to add more information to your 1099-R:

A: Qualified Charitable Distribution (QCD) - click on the Special Tax Treatment link at the bottom of Form 1099-R - Pensions and Distributions and enter your OCD there. There are several options here as well, which you may need for your 1099-R.

B: Exclude State Taxes - click on Advanced Options

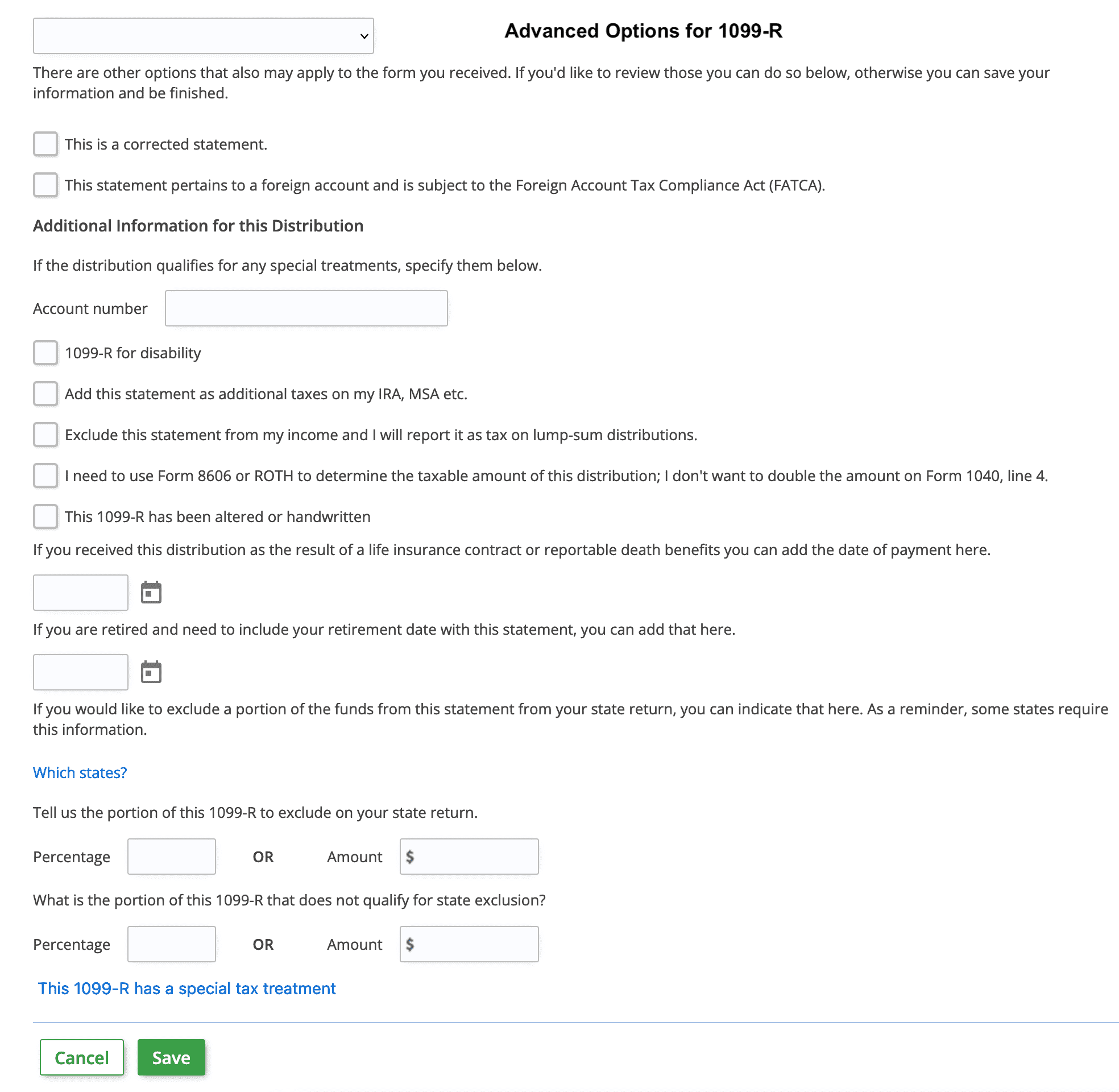

Advanced Options and Special Treatment Links on Form 1099-R:

Once in the Advanced Options screen, make the required selections and entries so that your 1099-R is entered correctly.

Advanced Options Page for Form 1099-R:

Add your retirement income, W-2 income, and all other taxable income to your eFile account, and your full return will be generated.

See also:

TurboTax® is a registered trademark of Intuit, Inc.

H&R Block® is a registered trademark of HRB Innovations, Inc.