Tax Return with Zero Income

When and wow do I prepare and e-File a Tax Return with little or no taxable income?

Please follow the instructions below to eFile a tax return if you had little or no earned income during the year. Only then do you follow these instructions below. Again, if you had zero income and low income during the tax year and generally do not file a return, however there are exceptions to this.

Low income or Non-filer types of income include:

- Social Security Income

- Nontaxable disability income (SSDI) or Supplemental Security Income (SSI)

- Foreign income excluded 2555 or Foreign Income Tax Exclusion

- Nonresident alien 1040-NR return

- Attention: It's very important to know that the zero Income tax return is NOT TO BE used if you did have taxable income or social security income in order to receive the third stimulus payment via the Refundable Tax Credit. Only follow these instructions if you indeed had zero income in during the tax year. All others must follow these instructions.

Follow the instructions below ONLY to e-file a tax return if you had 0 zero income income during 2022 or are generally not required to file a tax return. You can NOT do this to claim the third stimulus and as well as the Child Tax Credit. In some cases, you can also use these instructions to file your return if you had 0 Income in during the tax year and if your spouse filed a tax return as Married Filing Separately. The instructions below do NOT apply for social security income recipients, etc. All social security recipients please follow these instructions.

You may need to file a tax return or want to, even if you do not have any taxable income. To do so, you can use the instructions below to force the return to generate as not adding any taxable income will not allow you to file.

Follow these steps:

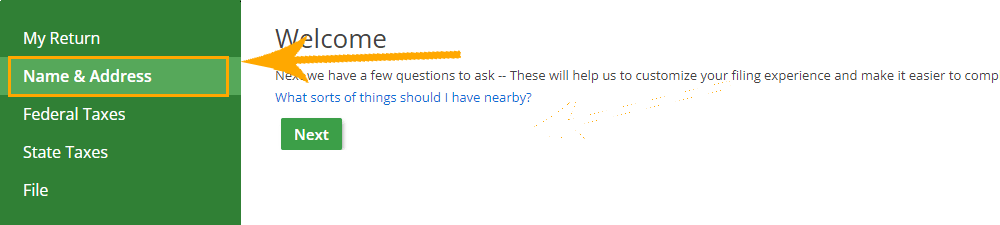

2. Enter your personal details.

Start the tax interview process by entering your personal details on the "Name & Address" screen.

3. Click on Federal Taxes in the left menu.

4. Click on Review

under Federal Taxes.

5. Click the link I’d like to see the forms

I’ve filled out or search for a form.

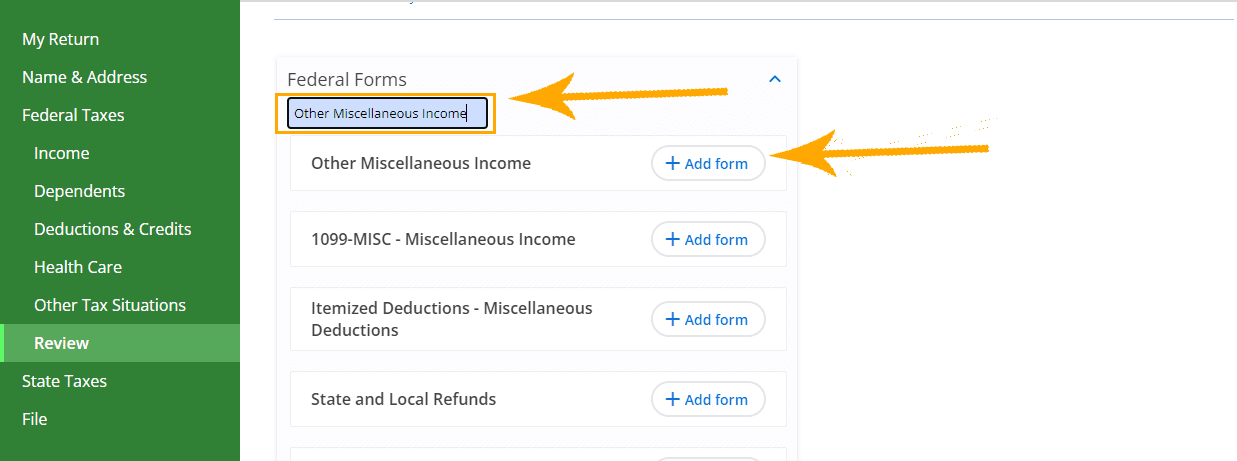

6. Add Form "Other Miscellaneous Income".

In the search field, enter "Other Miscellaneous Income" and then click the "+Add form" button next to the Other Miscellaneous Income heading.

7. Click the link I still don't see what I'm looking for. at the bottom of the Other Miscellaneous Income screen.

8. Click the link Add another.

9. Click the link I want to add my own income description.

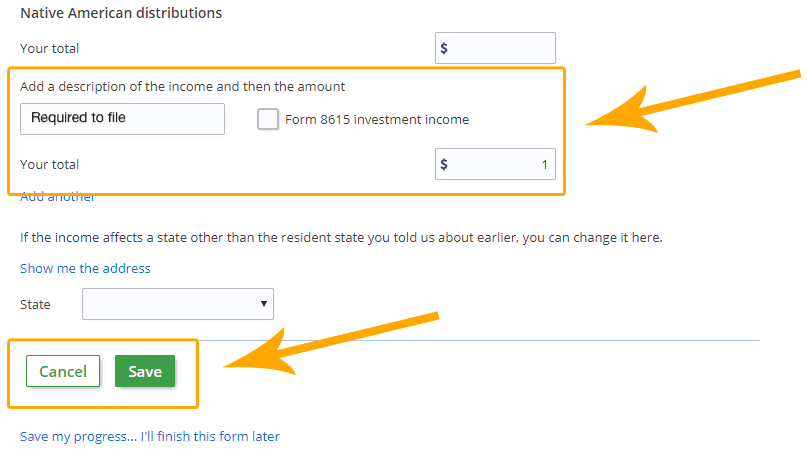

10. Enter Required to file.

Enter "Required to file" in the description box and $1 in the Your total box. Click the "Save" button when done.

Start Free Now

Already have an eFile.com account? Sign In

TurboTax® is a registered trademark of Intuit, Inc.

H&R Block® is a registered trademark of HRB Innovations, Inc.