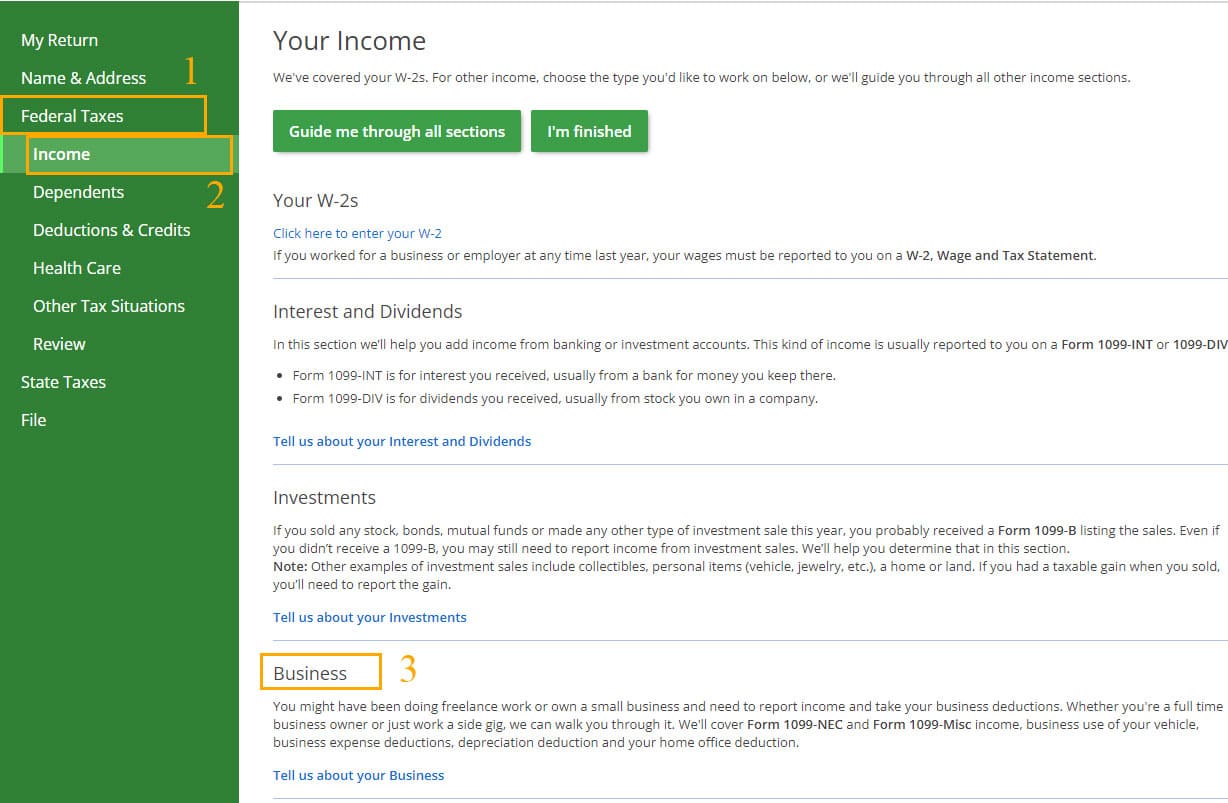

2. Where Do I Enter Data?

eFile will guide you through entering all types of income. Most of the time, these transactions are for your business or if you are self-employed. Under Income, work through the Business section and add the income from your 1099-K under the section that reads

Do you have business income to enter that's not reported on a Form 1099-NEC or 1099-Misc?

Click to enlarge image

3. How to Manually Add Data

To manually add your form, navigate to Federal Taxes > Review > I'd like to see the forms I've filled out or search for a form and enter "Schedule C." You can then fill out the details based on your information and add the 1099-K income under the Business Income section.

4. Box Descriptions

There are many boxes on the form, but below are the most common that will be filled in.

1a: Gross amount of payment card/third party network transactions

1b: Card Not Present transactions

3: Number of payment transactions

4: Federal income tax withheld

6-8: State details.

5. How to Add, Delete a Form or Page