Additional Taxes on Qualified Plans

Question:

How do I enter 1099-Q or other tax forms reporting income I received from savings, retirement, or investment plans?

Article, Solution:

Taking distributions from education savings accounts for qualified education expenses is tax-free. This includes plans like Qualified Tuition Programs (QTP), also known as 529 plans and Coverdell ESAs. If your distributions for the year are more than your qualified education expenses, you may be required to report the excess as income and pay taxes plus a 10% penalty. Or, if you took a distribution from the account which was not used to pay for qualified education expenses, then the tax may be assessed.

You will generally receive Form 1099-Q reporting this information when you take a distribution. If this was used to pay for qualified expenses, then you would keep this form for your records, meaning it generally does not get filed with your return. If not, you can add this to your return.

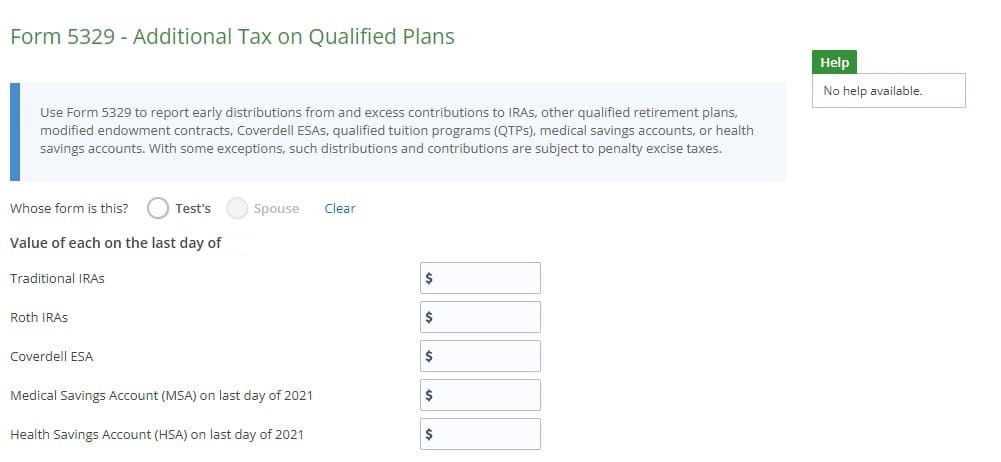

To enter your QTP/Coverdell ESA information, navigate to Federal Taxes > Review > I'd like to see the forms I’ve filled out or search for a form > type "529" or "5329" in the search box > click Add form next to Form 5329 – Additional Tax on Qualified Plans.

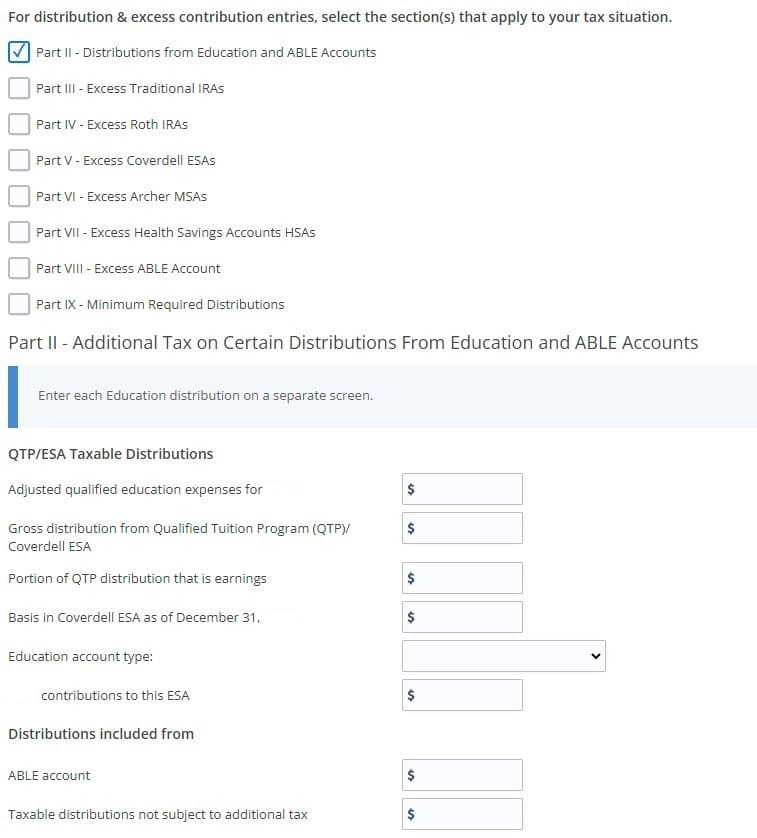

Here, choose who the form is for and fill in the applicable fields, then scroll down to check the box for Part II - Distributions from Education and Able Accounts. Enter your adjusted qualified education expenses for the current tax year. To calculate your “adjusted” amount, take your total qualified education expenses and subtract the following:

- Tax-free assistance received in the tax year (scholarships, Pell grants, etc.)

- Any expenses used in figuring education credits or the tuition and fees deduction.

From this information, eFile will calculate any additional tax that is required. If you want to see how the form is generated, view your return by clicking on My Account and opening the PDF file of your return so far. Here, view Form 5329 - Part II to verify any additional tax. The tax will carry to Form 1040 Schedule 2, line 6.

TurboTax® is a registered trademark of Intuit, Inc.

H&R Block® is a registered trademark of HRB Innovations, Inc.